Sports

How the new deal between Disney and Fubo will impact how fans consume sports TV

The corporate maneuvering over your sports viewing dollars may offer more drama than some of the games that you pay to watch.

The streaming wars that have been bubbling under the surface of the TV business are now fully upon us. The emerging digital powers, Amazon Prime Video, Google YouTubeTV and recently Netflix have announced their arrival with NFL, NBA, WWE and, perhaps soon enough, UFC deals.

The old guard — ESPN, Fox, NBC, CBS and TNT Sports — have seen them on the horizon, but their streams are now in full view. To fight back the digital behemoths, the traditional players are forming new alliances.

That is why Disney’s latest salvo to maintain ESPN as the eternal sports empire has it combining its Hulu + Live TV business with Fubo, a direct result of the emerging threat.

ESPN is trying to live up to its credo: “To Serve Sports Fans. Anytime. Anywhere.”

It is a nicer, corporate way of saying: We would like everyone to pay us.

ESPN’s chairman Jimmy Pitaro and his right-hand executive, Burke Magnus, first created a sports-rights moat by outlying nearly $80 billion over the past seven years for the NFL, NBA, college football and MLB, among other properties. Now, it wants to conquer distribution, which ESPN once dominated but now is being overrun by the Netflix, Amazon, Google and the like.

ESPN once had 100 million cable and satellite subscribers and now has 65.3 million, according to Nielsen’s latest tally.

The combined Fubo and Hulu + Live TV has 6.2 million subscribers and represents a legit competitor to YouTube TV’s platform that approaches 10 million subscribers. (The Athletic has a commercial partnership with Fubo.)

ESPN is available on YouTube TV, as well, but Disney has no ownership stake in the Google platform.

Further, the agreement between Disney and Fubo effectively settles the Fubo-led litigation from earlier this year that has prevented Venu Sports – the joint venture to present ESPN, Fox Sports and TNT Sports in what the cool media kids like to call a “skinny bundle” — from launching.

Venu does not have the full green light, but March Madness feels like a potential starting point. The idea of ESPN, Fox and TNT Sports combining would have been blasphemy a decade ago, but these entities are trying to survive and thrive in a Netflix world.

For consumers, it all still remains way too messy to try to figure out where, how and for how much to watch all these games. ESPN’s goal is to meet you, wherever you are.

In the late summer, likely August, ESPN will offer its “flagship” direct-to-consumer product, which The Athletic has previously reported is right now aiming at the $25-30 per month range. ESPN flagship will give consumers access to all of the network’s programming without any other subscriptions.

Venu Sports, the ESPN/Fox/TNT confab, announced its initial offering would be $42.99 per month, though that is likely to quickly jump to $45-50 per month. Like YouTube TV, Fubo and Hulu + Live TV will be in the $70-80 range with more channels besides sports. Each customer pays about $10 for ESPN’s channels in these bundles.

Do you see ESPN’s plan? ESPN wants to be available to entice consumers at different price points. You will be able to access it in the $10 range as part of the $70-80ish YouTube TV, Hulu + Live TV or Fubo universe, or at $25-30 per month as an ESPN standalone, or potentially with Venu at $45-50 per month.

ESPN already enters the battle with maybe the greatest set of rights in sports TV history as it includes Super Bowls, NBA Finals, college football championships, Stanley Cups and more. There is not much to bid on in the near-term, except for UFC.

Amazon Prime Video already added the NBA to its NFL offerings. NBC/Peacock swiped the NBA from TNT Sports.

And, now, here comes Netflix.

It is lurking, playing at a global scale. With its Christmas NFL games, it has a relationship with the most powerful professional sports league in the world. It recently inked the Women’s World Cup for the next two tournaments.

Netflix is just beginning a decade-long agreement with WWE, with its first live telecast airing Monday Jan. 6. Like WWE, TKO owns UFC. UFC is currently a part of ESPN, but Netflix is considered a strong contender for the next deal.

And this is how we got to Monday’s Disney-Fubo announcement. ESPN wanted to maintain its Fubo subscribers, keep Venu alive and create a YouTube TV competitor. It can’t afford to lose anymore with Netflix and Amazon having unlimited resources.

It’s the corporate game inside the game for how you watch your games.

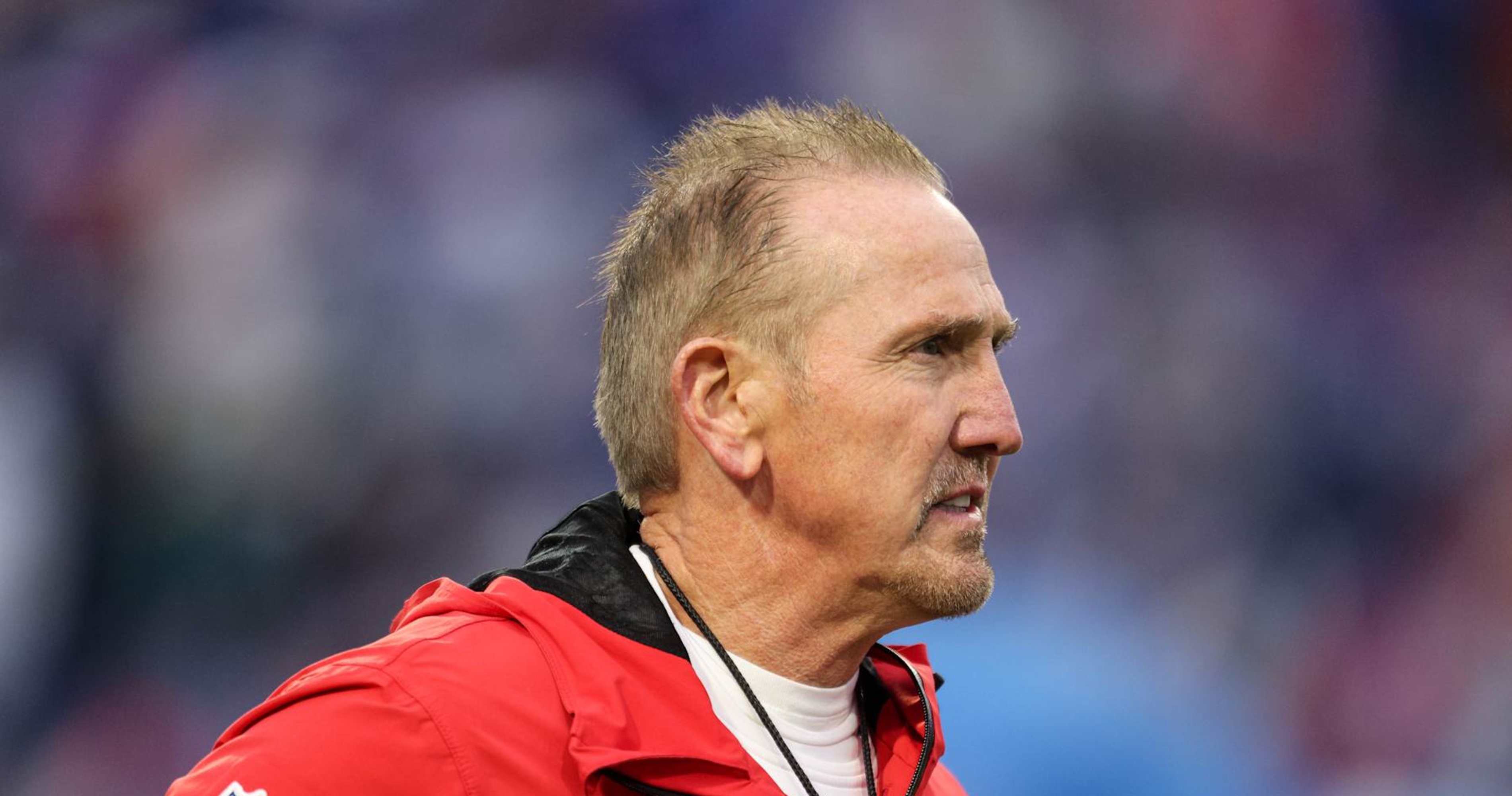

(Photo by Patrick T. Fallon / AFP via Getty Images)