Jobs

New report finds NYC’s short-term rental law takes toll on outer boroughs

Before New York City’s stringent short-term rental law took effect, Airbnb listings made up less than 1 percent of the city’s total housing supply1. Nonetheless, Local Law 18 (LL18) was introduced with the promise of tackling the city’s housing crisis, a promise that data shows remains unfulfilled.

A new report by HR&A Advisors reveals that the law has not only failed to improve housing affordability, but instead could lead to less economic and fiscal impacts from Airbnb for the city and hosts– – all the while benefiting the hotel industry by pushing room costs significantly higher.

Billions potentially lost in Airbnb visitor spending, especially in the outer boroughs

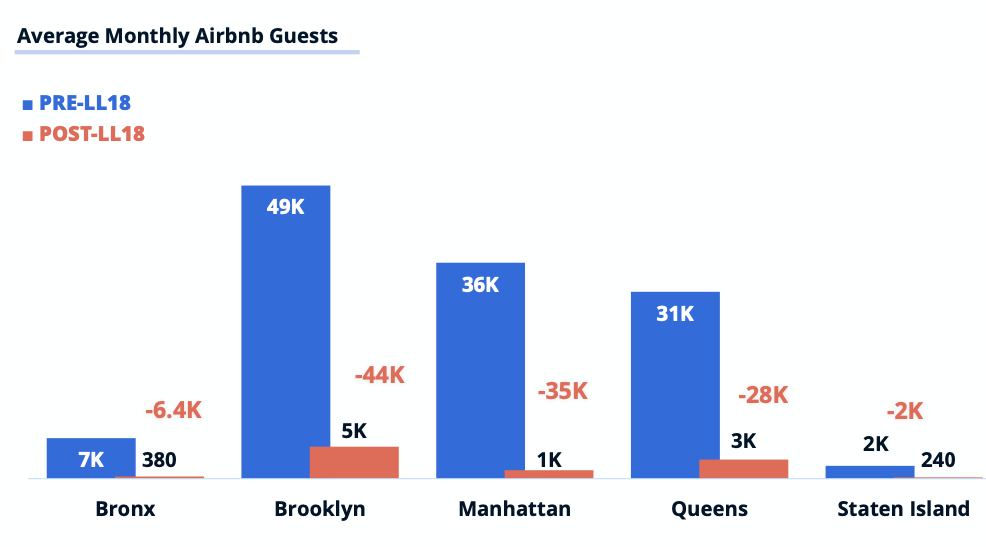

LL18 resulted in an over 90 percent drop in Airbnb listings across New York City following its implementation in September 2023. In the outer boroughs alone, listings dropped from approximately 17,000 to 1,400, resulting in an average of 80,000 fewer guests per month on the platform.2

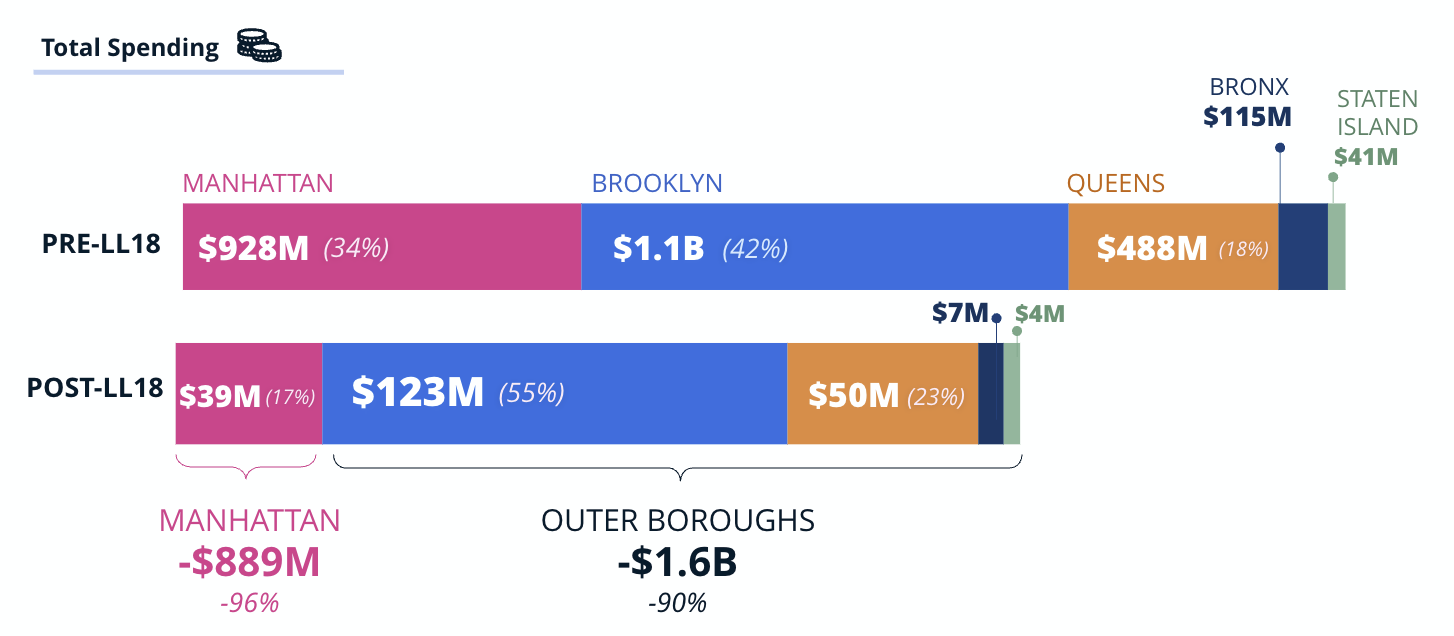

As a result, LL18’s effects are rippling through NYC’s economy. With short-term rentals sharply limited, the city could potentially see $2.5 billion less in spending from Airbnb guests , impacting small businesses and local economies, citywide3 – the vast majority of the impact found outside Manhattan.

This decline in spending is anticipated to cost more than 21,000 jobs and $902 million in worker wages, according to the report. Additionally, the decrease in short-term rental revenue means that New York City and New York State could experience a loss of $96 million in estimated tax revenue generated from Airbnb guests — a shortfall equivalent to funding nearly 300 public school teachers.

With the decline in guests, the outer boroughs could potentially experience $1.6 billion less in visitor spending, more than 15,700 fewer jobs, and $573 million less in worker wages. For local businesses in Brooklyn, Queens, the Bronx, and Staten Island, the economic impact of LL18 is substantial, reducing the opportunity for economic activity that guests once provided. This financial toll illustrates the far-reaching economic consequences LL18 has caused for New Yorkers.

Before September 2023 when LL18 took effect, Airbnb’s listings spanned all five boroughs, allowing visitors to explore beyond Manhattan. Nearly 70 percent of Airbnb’s NYC listings were run by hosts located in Brooklyn, Queens, and the other outer boroughs, contributing tourism revenue to these communities.

LL18 has now limited these options, clustering more travelers into Manhattan and restricting tourism spending.

LL18 fails to boost housing availability or affordability

The outer boroughs were previously home to nearly 70 percent of Airbnb listings in New York City. To isolate the potential impacts of LL18 on housing inventory and rents, the report analyzed New York City neighborhoods that had a higher4 and lower concentration of Airbnbs prior to LL18.

Championed as a law to increase housing availability and affordability, HR&A’s findings reveal that neither housing availability nor affordability has improved since LL18 was enacted. In fact, rents rose faster in areas that previously

Meanwhile, citywide vacancy rates have remained unchanged at 1.9 percent, highlighting LL18’s ineffectiveness in addressing the city’s housing challenges.

A win for Manhattan hotels, a loss for consumers

The hotel industry, which lobbied for LL18, has seen a major financial benefit in the law’s wake while travelers bear the brunt of its impact. Since LL18 took effect, hotel prices have surged, making it increasingly expensive to stay in New York City. Hotel Average Daily Rate has risen by 6 percent from May 2023 to May 2024, according to the report. In fact, New York City recently reached a record-high ADR of $524, an over 50 percent year-over-year increase.

Over the same period, hotel occupancy rose approximately five percent and is expected to continue to grow as the city’s visitor numbers are projected to outpace pre-COVID figures by 2025.

LL18 has also drastically reduced accommodation options outside Manhattan with only 20 percent of NYC’s hotel rooms being in the outer boroughs, compared to nearly 70 percent of Airbnbs prior to the law. The result? Visitors are now clustered in Manhattan, with a constrained hotel supply.

These factors signal that New York City may lose a unique visitor segment – budget-conscious families looking for large, private accommodations in convenient locations.

LL18 has failed to deliver on its housing promises, while driving up travel costs, concentrating tourism revenue in Manhattan, and disproportionately impacting the outer boroughs. It’s time for New York City to reconsider LL18 so that it can once again welcome visitors to all corners of the city, fueling the economy and supporting residents and businesses with the tourism spending they can no longer rely on.