Travel

Who’s the Business Travel Customer in 1987?

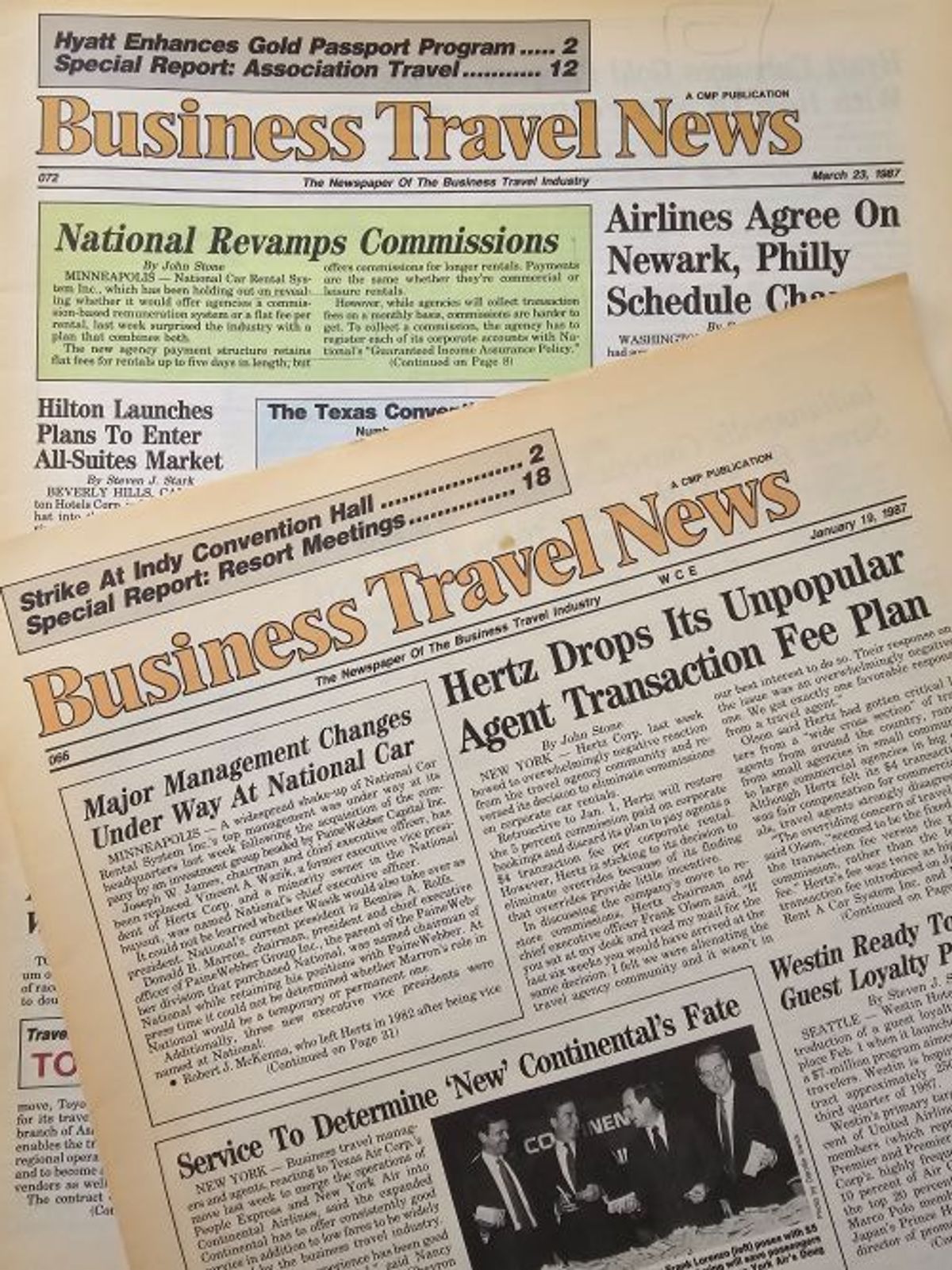

BTN’s archive issues are back in full strength in 1987. The newspaper published three times monthly that year, and there was plenty of news to fill its pages—and advertisers, too. The corporate travel market remained

fragmented, contributing to the active pool of travel suppliers and intermediaries who wanted to capture business travel accounts.

Judging from the advertisements, however, suppliers had lots of different ideas about who was running the business travel show. Did they need to capture the attention of corporate executives? A business travel manager? So-called “secretaries” (there are a strange number of ads featuring lacquered fingernails holding written travel requests from “the boss”)? Or, were they trying to appeal to travelers themselves?

Travel suppliers, in particular, were trying to figure that out—and, honestly, if the week ending May 31, 2024, teaches us anything, it’s that the industry is still trying to answer that question 37 years later.

Let’s look at where car rental companies—pressurized by the federal Tax Reform Act of 1986—landed on it when faced with their own make-it-or-break-it commercial decision-making moment.

It was clear by January 1987 that car rental companies had been turned on their heads by the 1986 Tax Reform Act, which removed the tax incentives associated with automotive purchases. Until then, the parent companies of car rental outfits had not been too worried about the actual profitability of those concerns when federal incentives associated with stocking fleets were serving up some sweet cash flow. With that stream drying up in 1987, however, parent companies were selling off car rental firms, which forced the latter to adopt new commercial strategies and take on a much more competitive posture.

Car rental companies were vying for both margins and market share. Once competitive mainly on price, firms broadly increased rental rates that year, they diversified their target customers and they began to compete on service.

Hertz and Avis, which had long courted business travelers, began wooing the leisure market. Budget, then operating on its own as mostly a leisure brand, started chasing the corporate market. National, according to an Oct. 1987 article in the New York Times, was already covering the lot. Smaller players, like Dollar and Thrifty, also were in the business mix, not yet acquired by Hertz, which would happen much later.

Innovations like quick rental lines that utilized “cellular telephone technology,” automated remote rental interfaces where customers would talk via a computer screen to a remote desk agent began to pop up. As did frequent renter perks and loyalty programs—National’s Emerald Club launched in 1987.

And this is where that question about who, exactly, is the business travel customer got fuzzy—or not—for the car rental firms because, just like today, business travel has to serve a number of masters.

The corporate travel agency is one of those masters. On January 1, Avis, National and Hertz started addressing margin from the agency angle, cutting commissions to a flat transaction fee. Avis and National went to as low as $2 for a short rental. Hertz’s landed at $4 across the board.

By mid-January (yes, two weeks later), Hertz’s chairman Frank Olson had been so inundated with negative agency reaction and threats to steer business travelers to other car rental brands like Dollar and Budget, which had maintained commission structures at 5 percent, that he restored agencies to the full commission model. Avis returned to a straight commission model within weeks.

But National made a different move. In March (see the full timeline of major 1987 industry events below), it unveiled a highly complex structure with a flat fee upfront, followed by a volume incentive at year-end. In today’s market, such a system might be tolerated, but in 1987 the onus to track such data seemed to outpace the agency tech available to make it happen. I’m not sure how long this structure lasted for National, but I’ll update this article if I ever find out. It was the response of National’s executives to the consequent agency uproar that was particularly interesting.

BTN reported that then-company president and CEO Vincent Wasik along with three additional National VPs would personally call on each large corporate account over the following three months. To what end, though? Wasn’t this an agency commission matter?

Wasik did not tell BTN what discussion points those corporate account visits would include. Would they talk about direct deals, negotiate customized corporate rates? He did underscore to 1987 BTN reporter John Stone that in the future, National would offer pricing according to the corporate customer’s actual volume and not projected volume. A rather modern idea. Wasik also told Stone who he considered as the true corporate customer. Well, not exactly. I’ll let you be the judge…

He said: “While travel managers can’t control every renter, we think travel managers may not be doing all they can to get their travelers to adhere to corporate rental programs.” That statement clarifies, to me at least, in Wasik’s view, the corporate travel buyer by 1987 had become National’s business travel customer, over the agency and over the individual traveler. As such, to National, it was the travel manager’s decision to influence business travelers’ purchases—or not—and drive volume. Those customers who were able to drive that volume would get the better deals. It’s classic travel management in 2024.

It looks like American Airlines, this week, came to a similar conclusion and now is reconsidering the value of the travel manager relationship. The airline’s daring gambit to remove their lowest fares from agency EDIFACT channels discounted the power of the travel manager to drive booking volumes and prioritized the long tail of individual business travelers as their primary customer.

Since last April, leaders of large corporate accounts like Lockheed Martin, Takeda Pharmaceuticals and others wielded the power National’s Vincent Wasik recognized in 1987 to aggressively shift share away from American. The result wasn’t pretty for Dallas-based airline, with first-quarter corporate account revenue clearly lagging other major airlines in terms of growth. The airline conceded this week their strategies that did not fully consider the needs of their true target customer—that’s you, travel managers!

Enjoy the rest of the highlights from 1987 in the timeline below. You’ll notice below the stock market crash on October 19, 1987. Black Monday would amp up scrutiny of corporate travel going into 1988. I’ll meet you there next weekend.

_______________________________________________________________________

- UAL moves on its ill-fated travel integration strategy. It

acquires Hilton International for $980 million to complement the company’s

Westin Hotels, United Airlines and Hertz operations. It doubles UAL’s lodging

portfolio. - Former Hertz exec Vincent A. Wasik becomes chief executive

of National Car Rental after its purchase by PaineWebber. Wasik quietly

triggers an industry trend to increase rental rates. - Hertz bows to travel agency outcry, reversing a decision to

eliminate commissions and move instead to a flat transaction fee model. Avis,

which implemented the transaction fee model first, is forced to backtrack. - Woodside sells the Advanced Reservation System (ARMS) to

Citicorp Information Management Services. The sale is met with mixed feelings

from consortium member agencies.

- Price Waterhouse enters travel management with Air Auditor,

which it plans to market directly to corporate but also to agencies and

airlines. The product bogs down in development, but relaunches two years later. -

Led by Texas Air units Continental Airlines and Eastern

Airlines, U.S. carriers launch a round of deep fare cuts, signaling a radical

shift in airline pricing tactics. -

Four groups cancel planned gatherings in Arizona to protest

the governor’s refusal to make Martin Luther King Jr. Day an official state

holiday. - The U.S. Department of Transportation initiates a formal

probe of airline CRSs on the grounds of potential competitive abuses. The DOJ

just a year prior determined airline CRS owners did not have to divest their

interest in such systems. - UAL changes name to Allegis Corp. to signify identity as a

total travel industry supplier. - Martin Marietta Corp., the subject of a federal investigation

for two years, is fined and ordered to pay the government more than $1M in

travel agency rebates generated through travel by Marietta’s employees under

defense contracts. IVI Travel, the agency of record during the period under

investigation, was never part of the inquiry or indictment.

- All-suite hotel segment gains new players as Days Inn

announces a midprice product, Days Suites, and Hilton Hotels tosses hat in the

ring with Hilton Suites. - National Car Rental surprises industry with complex agency

payment structure combining flat transaction fees for short rentals and

commission for longer rentals. - State governments step up efforts to gain regulatory and price

control over car rental firm sales of collision damage waivers. Illinois and

New York are the first to eliminate CDW, but it takes two years.

- United Airlines Covia automation affiliate debuts a new

travel agency workstation called Focalpoint. It combines flight booking on

Apollo with agency-programmable features and office automation. - Five midwestern corps form a joint venture Association of

Corporate Travel, designed to pool purchasing power and negotiate bulk deals

with suppliers. - Air Atlanta files for bankruptcy.

- Peter Jensen orchestrates the formation of the Association

for Corporate Travel Executives. Members will include travel managers, agencies

and suppliers. Some see ACTE as a threat to NPTA (precursor to GBTA), which at

the time includes only buyer members. - Residence Inn sells to Marriott Corp.

- Four media industry groups pull meetings out of Florida to

protest new law that places a 5 percent sales tax on all advertising in the

state. - Allegis chairman Richard Ferris sticks by his integrated

travel strategy in the face of a $4.5 billion buyout offer from United

Airlines pilots union. - Alaskan agency TravelCenter files for bankruptcy, pointing a

finger at ARC remitting procedures. Lifeco acquires the agency.

- Allegis chairman Richard Ferris forced to resign; integrated

travel supplier strategy is dismantled as buyers are sought for Hertz, Hilton

and Westin, and new partners for Covia. - Plans revealed for a new CRS in Europe called Amadeus.

- Thrifty Rent-A-Car goes public.

- Woodside’s largest domestic volume producer IVI Travel pulls

out of the consortium. - Congressional committees consider legislation to change tax

deductibility status for business meals and entertainment from 80 percent to as little

as 50 percent.

- Hotel companies start to set limits on corporate rate plans

after some chains encounter problems administering programs that have become

too large. - Hilton Hotels develops concept for Cresthil by Hilton to

compete with Courtyard by Marriott. The brand does catch, but it becomes a foundation for Hilton Garden Inn, according to some internet reports, which launches in 1990.

- Department of Transportation mandates that airlines disclose

monthly on-time flight performance and baggage handling data. - American Airlines debuts Capture travel expense accounting

system, the carrier’s first effort to deal directly with corporates on an

automation product. It halts marketing on that system in 1989. - Ladbroke Group PLC acquires Hilton International from

Allegis for $1.07B.

- Black Monday rocks the business travel industry. Oct 19

stock market crash causes corporations to scrutinize business travel costs and

policies. - Avis employees buy the firm in an employee stock ownership

plan. Arch-rival Hertz is acquired by an investment group of senior management

and Ford Motor Co. - Senate Appropriations Committee bans in-flight smoking on

domestic flights less than two hours, in a three-year trial.

- Allegis sell-off continues with Westin acquired by Bass

Group and Aoki Corp. for $1.53B. - DOT publishes first monthly on-time performance stats,

revealing that 23 percent of U.S. flights arrive more than 15 minutes late. - Hyatt discloses plans to enter high-end, all-suite market

with Hyatt Regency Suites.

- Stephen Wolf takes helm at Allegis and United Airlines.

- Florida repeals 5 percent service tax, and corporates reconsider

it as a meetings destination.

_______________________________________________________________________

Elizabeth West is the editorial director of the

BTN Group. She has reported on the business travel and meetings industries for

24 years. Beth was editor-in-chief of Meeting News from 2006 to 2008 and

director of content solutions for ProMedia Travel from 2008 to 2011, when

ProMedia was acquired by Northstar Travel Media and merged with BTN. She became

editor-in-chief of BTN in 2015 and editorial director of the BTN Group in

2019.

_______________________________________________________________________

Credit: BTN recreated the timeline in this article from a list of industry

events compiled by editors of BTN’s 1989 fifth anniversary retrospective: Jim

Alkon, Jeanette Borzo, Judi Bredemeier, Mary Brisson, Barbara Cook, Richard

D’Ambrosio, Shann Davies, Larry Kilman, David McCann, Laura Koss, Don Munro,

Imitiaz Muqbil, Jody Oesterreicher, Magdalene Ruzza. Thanks guys!